What is Direct Health Care Contracting?

Self-insured employers can have direct arrangements with providers which can create innovative cost controls and address workforce needs.

A collaborative concept that can empower employers and influence costs

Thinking about employer-sponsored health care is keeping many business owners awake at night. Aside from concerns about rising costs, there are many considerations associated with a changing workforce. When employers make decisions about their health insurance plan, they are balancing the needs and wants of a diverse employee population. Unfortunately, plans offered by major insurers are often limited to a few one-size-fits-all options.

The situation has ignited an interest in direct health care contracting. In varying degrees, direct contracting arrangements circumvent the role and need for commercial payers and third-party administrators (TPAs). These arrangements, made directly between employers and providers, allow innovation and collaboration in controlling costs and addressing specific needs of the employer and his or her workforce.

What is direct-to-employer contracting?

Rather than going through an insurance company, direct-to-employer (D2E) contracting means that a self-insured employer works directly with a health care provider, usually a large health system, accountable care organization, or population health management firm. Together they negotiate the terms by which the provider will supply and manage the health care for the company’s employees and their dependents. The arrangement may cover the full range of services outlined in the plan or may be designed to address specific services such as joint replacement surgery, cardiac catheterizations, or other medical procedures.

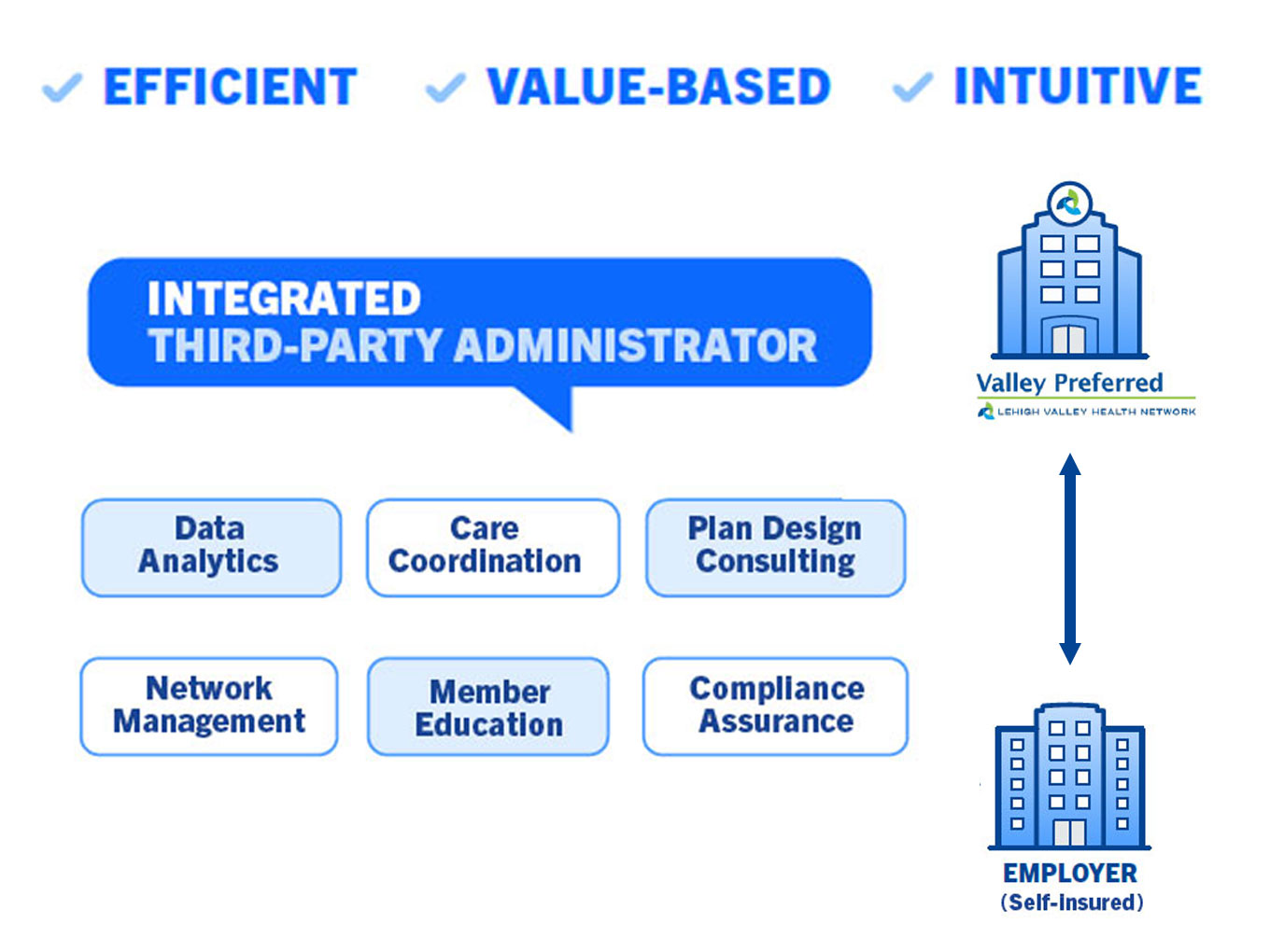

To understand direct contracting, it’s helpful to look at a traditional employer-provider relationship. Typically, a self-insured employer would utilize a TPA for services the provider could not deliver like plan design, enrollment, customer/member service, claims administration, and rate negotiation with practitioners. Often, the TPA would be a department within the insurance company, requiring standardization in networks and rates. Therefore, individual needs of a particular employer or employee population are not a priority or even a possibility.

The difference in a D2E contract is that the provider assumes responsibility for these functions – usually not all of them. However, in the case of an integrated TPA that specializes in population health management and has its own analytics, care management, and claims administration capabilities, TPA services can be managed entirely by the provider without the need to outsource. This serves not just to mitigate costs, but also to concentrate control with the employer and provider exclusively.

Does direct-to-employer contracting involve risk?

The answer is: it depends. A D2E arrangement between a self-insured employer and a provider is as much a financial agreement as it is a health services agreement. Employers want to be able to save money while also providing their employees with safe, reliable coverage. Therefore, a direct contracting relationship may involve incentivizing providers for achieving certain quality outcomes, such as prevention of hospital readmissions or successful care transitions between clinicians.

They also might choose a plan design with shared savings. In this situation, when savings are realized through strategies like care management or application of data analytics, the employer and provider share the funds saved when compared to an agreed-upon baseline.

Is your company ready?

Direct-to-employer plans potentially offer wins for all parties. Employers get leverage they didn’t have with traditional insuring arrangements. The provider is incentivized for pursuing better outcomes, which can free up resources to be able to engage in population health management. Members or employees get simplicity: in some cases, no deductible to be met, no co-insurance required, and few co-pays.

How do you know if your company is a candidate for D2E? Here are a few considerations:

- Ideally, employers should be self-insured or considering it.

- They should be able to design benefits based on current claims data and trends.

- At least 50% of the employee population should be inside the provider’s footprint and the headquarters should be domiciled there as well.

- Employers should have access to a provider that offers their desired service line capabilities and partners to cover any gaps.

- Employers should have access to a health system or provider that is experienced with accountable care organization (ACO) contracting and have the infrastructure build to expand to the commercial market.

- Employers should have access to a health system/provider that uses evidence-based outcomes and is willing to take some risk in providing fee-for-value versus fee-for-service.

Gain control over employee health care by going directly to the source