Why Companies Like GM & Walmart Opt for Direct Health Care Contracting

The alternative approach on how taking charge can mitigate health insurance costs & offer better benefit designs and offerings for employees

There are numerous factors driving the search for alternatives to traditional employee health care insurance models. Mostly, it’s a desire to mitigate costs as well as have more control over benefit designs and offerings. Either way, employers are starting to take charge.

One alternative that has gained popularity among self-insured companies is direct-to-employer health care, where a provider – usually a large health system – works directly with the employer rather than going through an insurance company. Together, they negotiate the terms by which the provider will supply and manage the health care for the company’s employees and their dependents. The arrangement may cover the full range of services outlined in the plan or may address only certain services in a “bundled” payment model.*

An aspect that employers like about direct arrangements is that each one can be different, based on the needs of the company and its employee population. As one executive noted, “It’s one of those things where if you’ve seen one, you’ve only seen one.”

Major employers are switching

In northeastern Pennsylvania, Jefferson and Main Line Health systems, which operate as strategic partners, have entered into direct health care contracting. Together, they have 40,000 employees and self-insured health benefits for 60,000 covered lives under the Delaware Valley ACO. Initially, their plan focused on a preferred network made up of their own providers. Later, they integrated care management and health coaching, wanting to demonstrate they could implement full-risk direct contracting with a large population.

Another example are health systems that have entered into direct contracting arrangements through participation in The Employers Centers of Excellence Network.** The network members partner with employers such as Lowes, Walmart, JetBlue Airways Corp., and others for specific services that include spine, bariatric, and cardiac surgeries. This arrangement represents the bundled model, where employers pay a set amount for certain, defined treatments. It shifts the risk to the provider, should there be complications and added costs above the original amount.

The employers in the contract offer incentives to their workers – such as covering copayments, deductibles, and travel expenses – toward choosing the contracted provider for their care. Those who choose providers outside the network pay a higher portion of the treatment costs.

General Motors chooses fewer limitations

General Motors (GM) was seeking greater control over the structure of their benefit plan and the value it generated. Leaders felt that GM and its employees were paying more every year, but the quality wasn’t keeping pace. The company developed a value-based care agreement with Henry Ford Health System (HFHS) based on what was important to GM and what the health system knew could be sustainable from its experience with risk-based contracts. The solution they chose encompasses:

- A more responsive and convenient physician network

- A customized benefit plan that encourages providers to deliver services without traditional managed care limitations

- Financial incentives for providers to manage costs and maintain quality

- Direct negotiation on components like service fees

With the HFHS offering, GM saved 17 percent per-member, per-month compared to its target in the first year and saved 14 percent over its goal in 2020. When the opportunity began, 10 percent of employees enrolled, which has since increased to 13 percent. GM executives are aiming for 20 percent participation in the future but based on how many employees already use Henry Ford physicians, participation could exceed 50 percent.(1)

The quest for innovative solutions

While companies such as GM, Lowes, Walmart, and JetBlue have different reasons for exploring direct health care contracting, the similarity is that they want a solution that truly benefits their employees and their business. Many have become frustrated by limitations and restrictions in plan design options and unqualified bundled payment agreements that don’t work for their employees, which are the typical choices in traditional insurance arrangements. These self-insured companies have found that going direct offers more flexibility, greater control, and – in GM’s case – member savings.

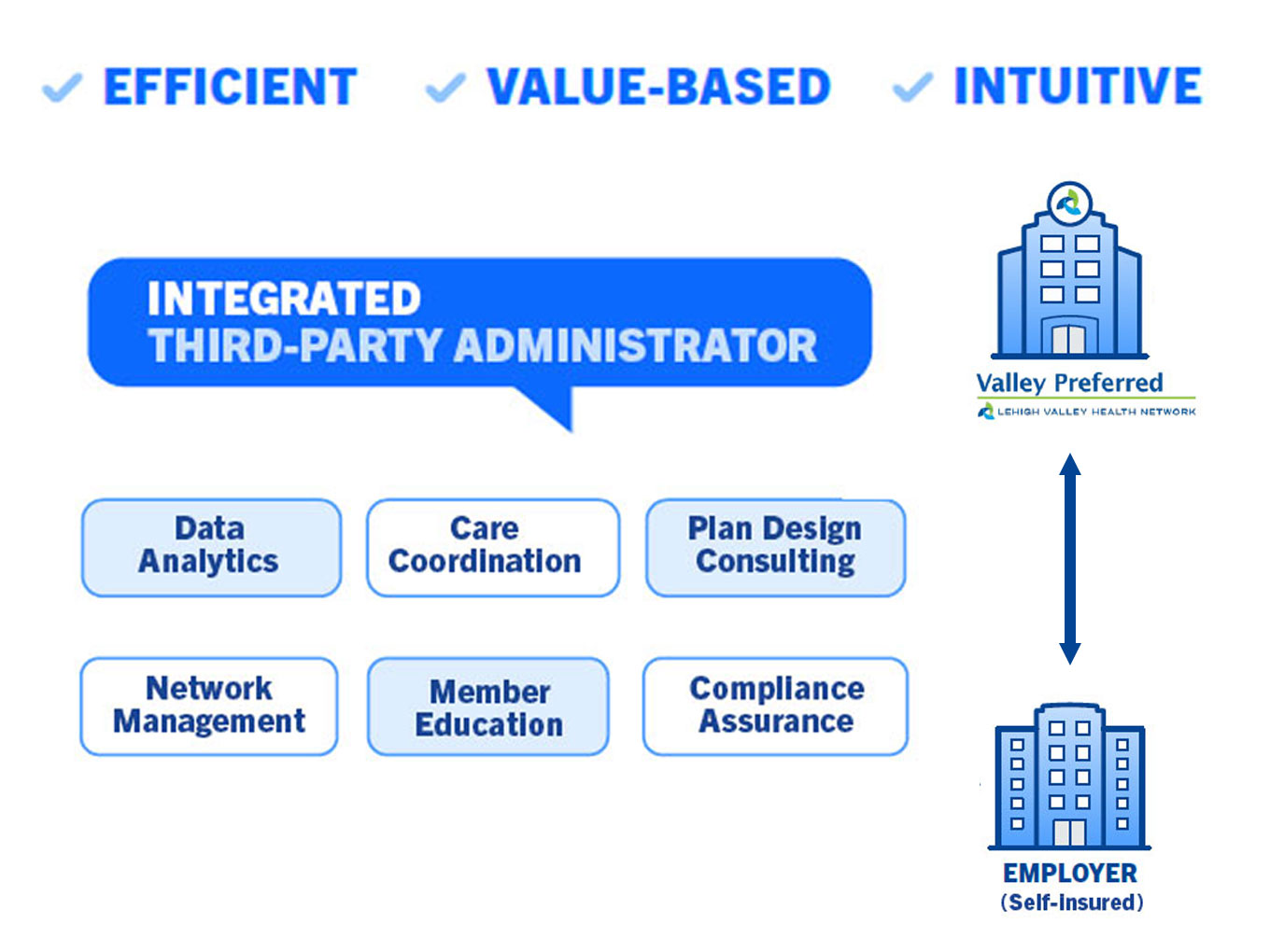

Locally, population health management firm Populytics has introduced Health Management Solutions, a concept that encompasses all the benefits of direct contracting including care coordination, integrated third-party administration, and alignment with top-tier providers through Valley Preferred, the provider organization aligned with Lehigh Valley Health Network. The company is responding to the changing needs expressed by employers throughout the region and the Philadelphia area.

According to Neil Goldfarb, president and CEO of the Greater Philadelphia Business Coalition of Health, coalition members have asked him to look out for provider organizations that are able to deliver quality performance guarantees and alternative payment models where providers take on shared risk. “There is a heightened awareness among companies that they have to change, or health care costs won’t improve,” Goldfarb said. “We may be at a tipping point. Employers are realizing they have to take on more responsibility.”(2)

*With bundled payments, the total allowable acute and/or post-acute expenditures (target price) for an episode of care are predetermined. Participant providers share in any losses or savings that result from the difference between this target price and actual costs.

** A partnership between the Pacific Business Group on Health and Health Design Plus, an Ohio-based care-management company.

Gain control over employee health care by going directly to the source